No schedule yetEnter your preferences, and take an optional diagnostic test to get a personalized study plan

If you're not using Knowt you're already behind.

Personalized schedules, exams, and more.

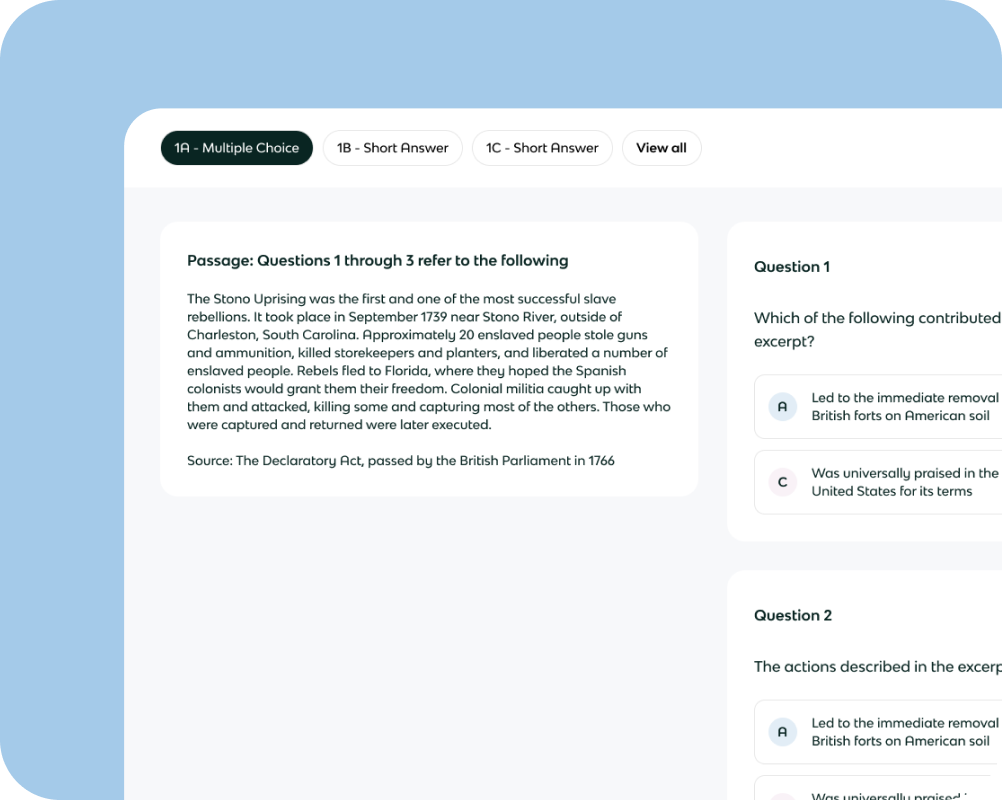

Unlimited mock exams using the same exact format as the actual AP exam

Get a custom study plan based on your exam date and the days you like to study

Study guides & practice for each unit in any AP Exam

Cram Sheets for last minute review

Start browsing our top notes & flashcards across a library of 5 million resources.

We're on the hot seat.